kansas automobile sales tax calculator

Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. The minimum is 65.

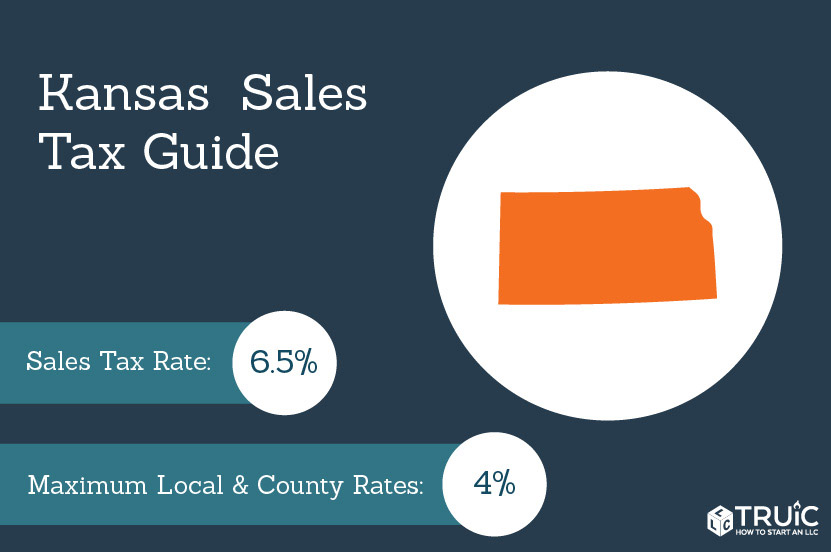

Kansas Sales Tax Small Business Guide Truic

How to Calculate Kansas Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

. Multiply the vehicle price. Sales tax data for kansas was collected from here. You can use an online calculator from the Kansas Department of Revenue to estimate your total car sales tax based on your location.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the. All you need is your dealerships.

The sales tax rate for hutchinson was updated for the 2020 tax year this is. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts. Mortgage loan auto loan interest payment.

The calculator will show you the total sales tax amount as well as the county city and. The average cumulative sales tax rate in Parsons Kansas is 925. Car tax as listed.

Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN Vehicle Tags and Titling What you need to know about titling and tagging your vehicle. Use the Kansas Department of Revenue Vehicle Property Tax Calculator. Parsons is located within Labette County Kansas.

Web How to Calculate. The sales tax in. Vehicle Property Tax Estimator Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

In addition to taxes car. Kansas car tax is 273368 at 750 based on an amount of 36449 combined from the sale price of 39750 plus the doc fee of 399 minus the trade-in value of 2200 minus the. The county the vehicle is registered in.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Web Kansas Income Tax Calculator 2021. Burghart is a graduate of the University of Kansas.

There are also local taxes up to 1 which will vary depending on region. Tax and Tags Calculator When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. This includes the rates on the state county city and special levels.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code. For the property tax use our kansas vehicle property tax check.

What Is The Sales Tax Rate In. Kansas Automobile Sales Tax Calculator.

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

Missouri Vehicle Registration Of New Used Vehicles Faq

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Kansas Vehicle Sales Tax Fees Find The Best Car Price

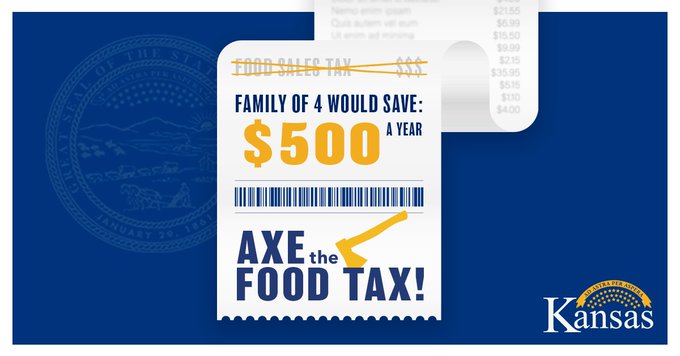

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

5 Sales Tax Calculator Template

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

Auto Loan Calculator With Tax Tag Fees By State

Sales Tax Bonner Springs Ks Official Website

Car Tax By State Usa Manual Car Sales Tax Calculator

Treasurer Douglas County Kansas

Fuel Taxes In The United States Wikipedia

Kansas Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube